FINTRAC Mandatory and Optional Fields: A Compliance Guide

Understanding FINTRAC Field Categories

Critical Compliance Requirement

Failure to complete applicable FINTRAC fields correctly can result in rejected submissions, non-compliance findings, administrative monetary penalties, and even criminal prosecution. FINTRAC uses a specific categorization system that all reporting entities must understand and follow.

One of the most common sources of confusion in FINTRAC compliance is understanding which fields must be completed versus which ones are optional. Misunderstanding these categories can lead to incomplete reports and potential enforcement action.

The Four Field Categories

1. Mandatory Fields (*)

Fields marked with an asterisk (*) must be completed. However, there's an important caveat: for attempted transactions, these fields become "reasonable measures" fields.

What this means:

- In completed transactions, you must obtain and report this information

- In attempted transactions, you must take reasonable measures to obtain it

- If you cannot obtain the information for an attempted transaction despite reasonable efforts, you may leave it blank

Example: The amount of the transaction is mandatory for a completed transaction but only requires reasonable measures for an attempted transaction.

2. Mandatory for Processing (‡)

Fields marked with a double dagger (‡) must be completed without exception. These are critical identifiers that FINTRAC needs to process your report.

What this means:

- No exemptions or exceptions apply

- Must be completed for all transaction types (completed, attempted, failed)

- Non-completion will result in an invalid submission

3. Mandatory if Applicable (†)

Fields marked with a dagger (†) must be completed only if they apply to your situation or the specific transaction.

What this means:

- Assess whether the field is relevant to your facts and circumstances

- If applicable, it becomes mandatory

- If not applicable, leave the field blank (do not enter "N/A", "Not applicable", or "unknown")

- This is where compliance judgment comes in

Example: The "Secondary Identification Type" field is mandatory if applicable—you only need to provide it if you have secondary identification for the individual.

4. Reasonable Measures Fields

All non-mandatory fields require you to take reasonable measures to obtain the information, if applicable.

What this means:

- You must make good faith efforts to collect this information

- Your policies and procedures should outline what "reasonable measures" entails

- If you already have the information in your systems or records, you must report it

- You are not required to obtain the information if doing so would tip off the person (the "tipping off" exemption)

Best practice: Document what reasonable measures look like in your organization. For example:

- Asking the client directly

- Checking internal systems and records

- Reviewing existing documentation

- Following up with contact information requests

Common Pitfalls to Avoid

Leaving Fields Blank

If data exists in your systems, you must report it—even if it's not mandatory. Failing to do so is non-compliance.

Invalid Placeholder Text

When a field is not applicable, leave it completely blank. FINTRAC prohibits "Unknown", "N/A", or placeholder characters.

Confusing Categories

Just because a field isn't mandatory doesn't mean you can ignore it. If it applies to your transaction, you must obtain and report it.

Undocumented Processes

FINTRAC audits verify that you followed established procedures. Vague or undocumented processes won't hold up under scrutiny.

Best Practices for Handling Fields

1. Build Comprehensive Data Collection Processes

Design your onboarding and transaction processes to capture all applicable information from the start. The less you have to chase down later, the fewer compliance gaps you'll have.

2. Create a Field Mapping Document

For each field category, document:

- Which fields apply to your business

- What reasonable measures your organization takes to obtain each field

- How information flows from client onboarding through to FINTRAC reporting

- Who is responsible for each step

This is essential for audit readiness and ensures consistency across your team.

3. Train Your Team on the Distinction

Your compliance team, AML officers, and front-line staff all need to understand the difference between these categories. A transaction analyst who doesn't know which fields are mandatory if applicable may miss critical information.

4. Use Systems to Enforce Compliance

Implement reporting tools that:

- Flag mandatory fields for completion

- Prompt users about applicable fields

- Prevent submission of incomplete mandatory information

- Track which fields were obtained through what methods

Spreadsheet-based or manual processes are high-risk for this type of categorization.

5. Regularly Audit Your Reporting

Periodically review submitted reports to ensure:

- All mandatory fields are completed

- All applicable fields that you have information for are being reported

- No unnecessary placeholder text is appearing in blank fields

- Your reasonable measures process is being followed consistently

The Role of Technology

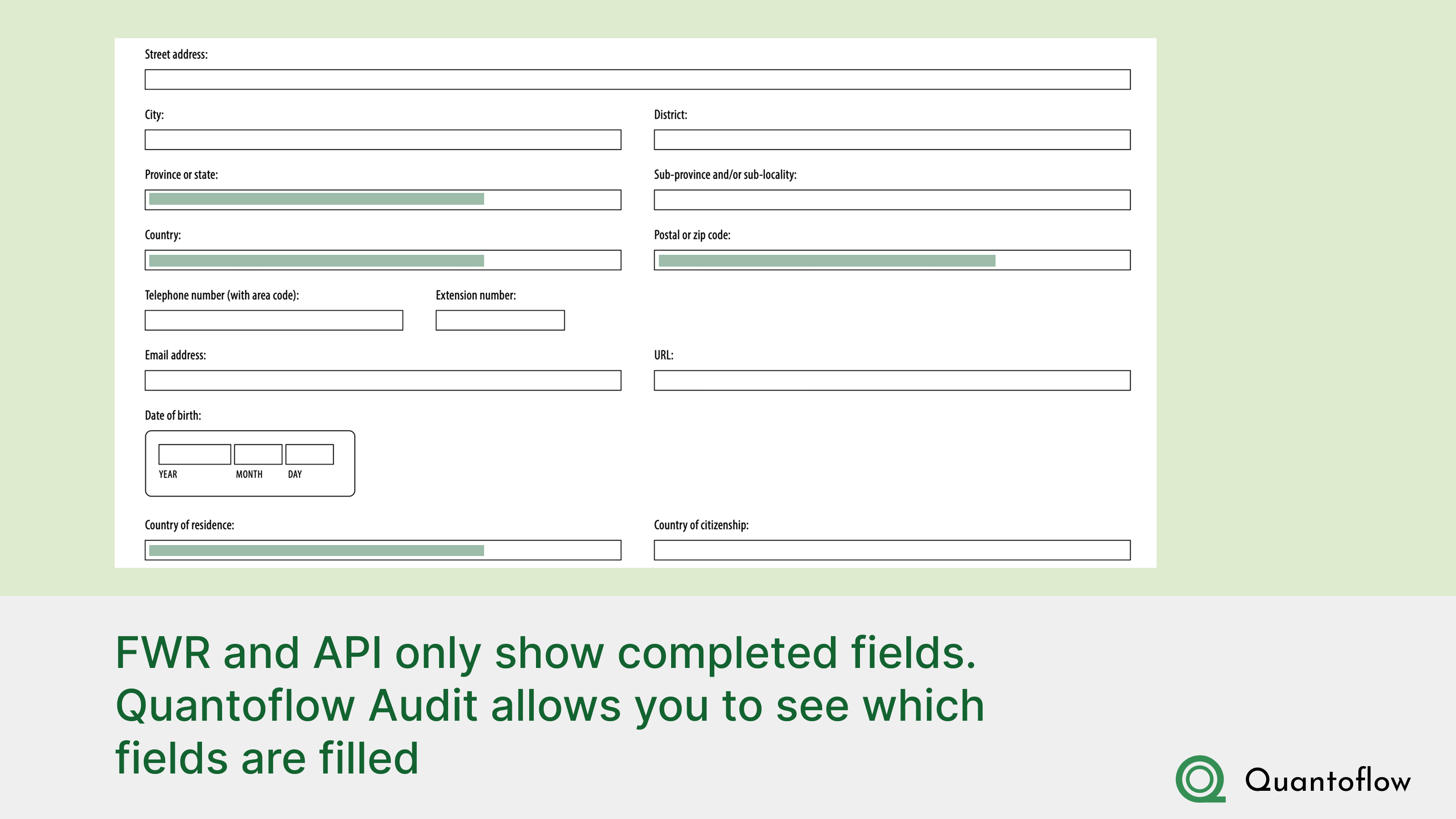

Many organizations struggle with field categorization because manual processes can't effectively track which information you have, which you've obtained through reasonable measures, and which fields truly don't apply.

A compliant reporting system should:

- Guide users through mandatory field completion

- Intelligently identify applicable fields based on transaction type and client profile

- Store your reasonable measures policies and apply them consistently

- Generate audit trails showing how and when information was obtained

- Flag gaps before submission

This reduces human error and demonstrates to regulators that your compliance processes are systematic and defensible.

Remember the Tipping Off Rule

One important exemption exists across all categories: You are not required to obtain information or take reasonable measures if you believe doing so would tip off the person or entity that you are submitting a Suspicious Transaction Report.

However, this exemption is narrow and shouldn't be used casually. Document any instances where you invoke it, and be prepared to justify the decision.

What Happens When You Get It Wrong

Failure to complete applicable fields correctly can result in:

- Rejected submissions from FINTRAC's intake system

- Non-compliance findings during examinations

- Administrative monetary penalties (AMPs)

- Criminal prosecution in egregious cases

- Reputational damage if enforcement actions are publicized

FINTRAC has been increasingly aggressive in enforcement, and field completion is a basic, defensible standard they expect all reporting entities to meet.

Moving Forward

The key to sustainable FINTRAC compliance is understanding that these field categories aren't arbitrary—they reflect FINTRAC's genuine intelligence needs and Canada's AML/CFT obligations.

By treating reasonable measures fields with the same rigor as mandatory fields, your organization demonstrates good faith compliance and significantly reduces audit risk.

- Review your current field mapping against FINTRAC's latest requirements

- Audit recent submissions to identify any gaps

- Document your reasonable measures policies

- Train your team on these distinctions

- Consider whether your current reporting tools support compliant categorization

The effort you invest now in understanding these categories will pay dividends in audit readiness and regulatory relationships down the line.

Struggling with Field Compliance?

If managing FINTRAC field mappings and categorization is consuming your compliance team's time, Quantoflow can help automate this process. We guide you through mandatory field completion, intelligently identify applicable fields, and generate audit trails—all while maintaining detailed documentation of your reasonable measures processes.

Learn How Quantoflow Can Help

Citations

- FINTRAC Reporting Instructions https://fintrac-canafe.canada.ca/guidance-directives/transaction-operation/str-dod/str-dod-eng#s11