Record-Breaking $176M FINTRAC Fine; where are things going next?

Overview

Breaking News

In an unprecedented enforcement action, FINTRAC has imposed a staggering $176,960,190 administrative monetary penalty on Xeltox Enterprises Ltd., operating as Cryptomus (previously known as Certa Payments Ltd.).

This record-breaking fine, announced on October 22, 2025, marks the largest penalty ever issued by FINTRAC and highlights the increasing scrutiny of virtual currency businesses in Canada.

Critical Compliance Failures

The compliance examination revealed multiple severe violations during July 2024, including:

-

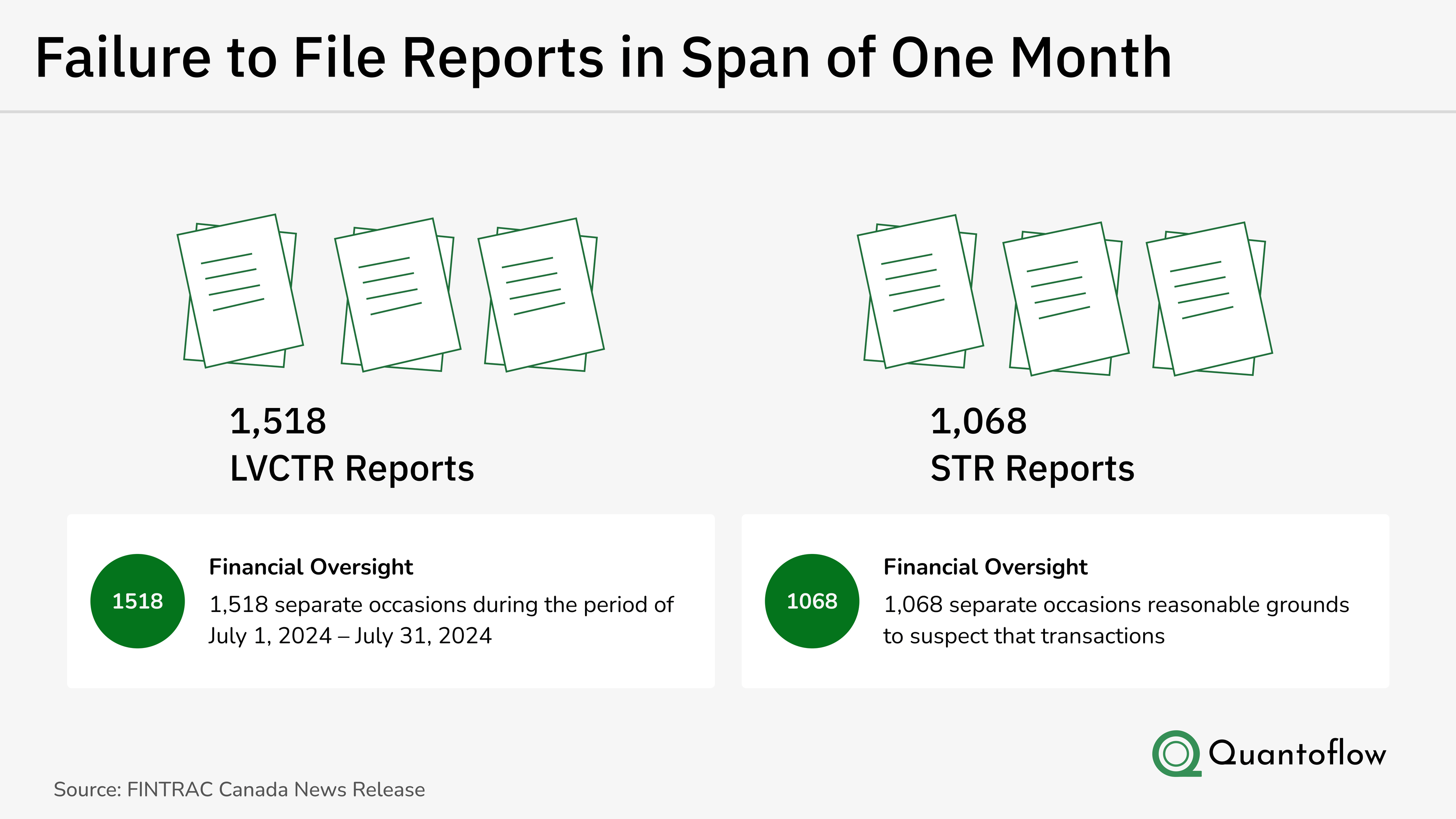

Massive Reporting Failures:

- 1,068 instances of failing to submit suspicious transaction reports

- 1,518 cases of failing to report virtual currency transactions exceeding $10,000

-

Systemic Compliance Deficiencies:

- Failure to comply with a Ministerial Directive

- Lack of proper written compliance policies and procedures

- Inadequate risk assessment documentation

- Failure to update registration information

Impact on Virtual Currency Sector

This enforcement action comes at a crucial time for Canada's rapidly expanding virtual currency sector. Sarah Paquet, Director and Chief Executive Officer of FINTRAC, emphasized the unprecedented nature of this enforcement action, stating: "Given that numerous violations in this case were connected to trafficking in child sexual abuse material, fraud, ransomware payments and sanctions evasion, FINTRAC was compelled to take this unprecedented enforcement action."

Broader Industry Implications

This case highlights several critical points for the virtual currency industry:

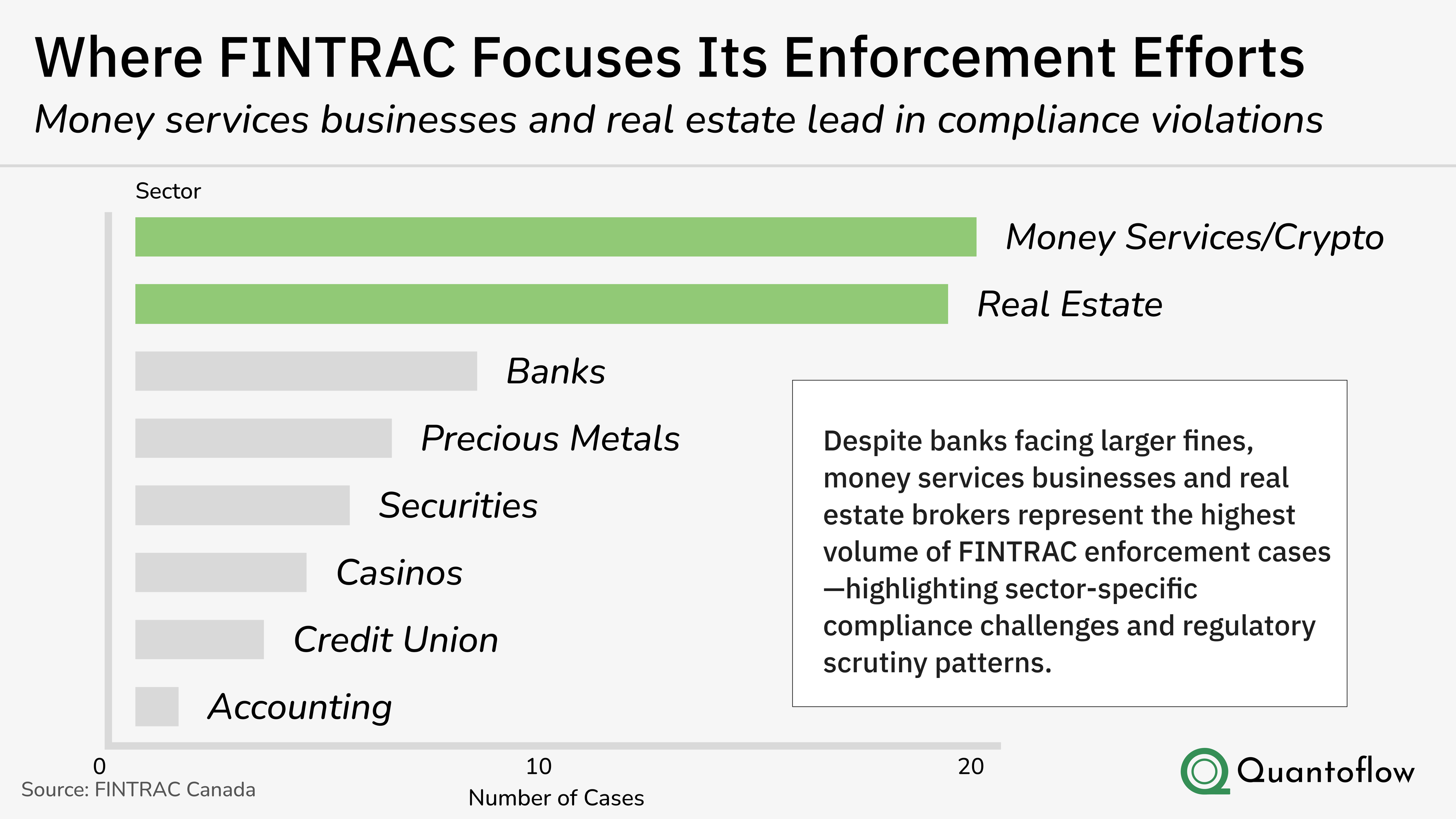

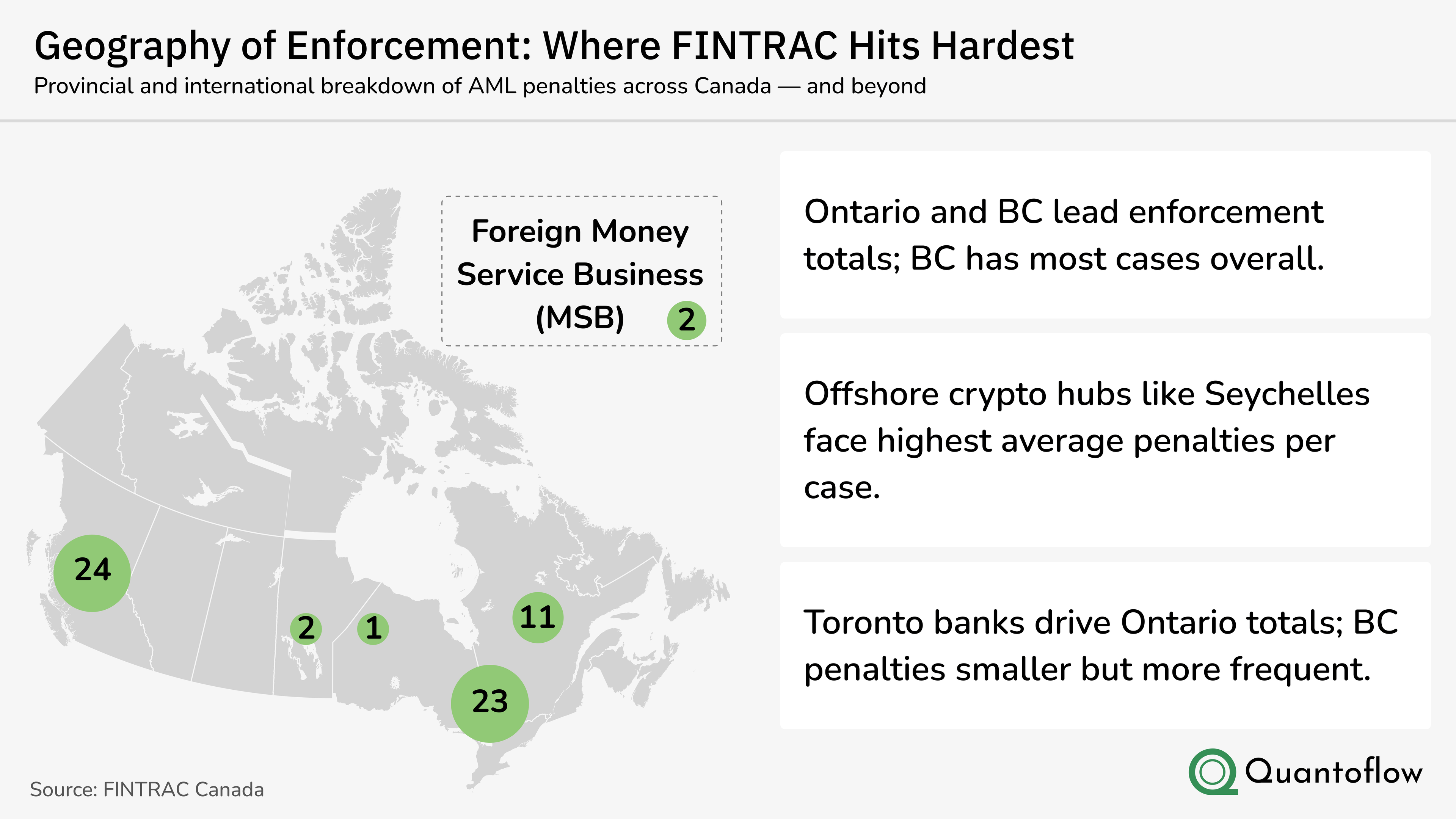

Increased Regulatory Focus: FINTRAC has significantly stepped up enforcement, issuing 23 Notices of Violation in 2024-25 alone, totaling over $25 million in penalties.

Virtual Currency Vulnerabilities: The rapid expansion of the virtual currency sector has brought increased risks of:

- Money laundering

- Terrorist financing

- Sanctions evasion

Compliance Framework Importance: The case underscores the critical need for robust anti-money laundering and anti-terrorist financing compliance controls in the virtual currency sector.

Key Takeaways for Financial Institutions

Suspicious Transaction Reporting

FINTRAC emphasizes that suspicious transaction reporting is vital for generating actionable financial intelligence for law enforcement.

Compliance Programs

- Up-to-date written compliance policies

- Senior officer approval for procedures

- Thorough risk assessment documentation

- Regular registration updates

Transaction Monitoring

Special attention must be paid to virtual currency transactions, with proper reporting mechanisms for transactions exceeding $10,000.

Conclusion

This record-breaking penalty demonstrates FINTRAC's commitment to enforcing AML regulations in the evolving virtual currency sector. Since receiving legislative authority in 2008, FINTRAC has imposed more than 150 penalties across various business sectors, with this case marking a significant escalation in enforcement actions.

Need Help With FINTRAC Reporting?

If your company faces a backlog with FINTRAC reports, Quantoflow offers automated FINTRAC reporting that can handle your backlog within days to meet FINTRAC's requirements.

Contact Us Today

Citations

- FINTRAC News Release https://fintrac-canafe.canada.ca/new-neuf/nr/2025-10-22-eng