Understanding FINTRAC's Intelligence Value and Enforcement Strategy

A big question for any firm is what does FINTRAC or the non-abbreviated term, Financial Transactions and Reports Analysis Centre of Canada do and what value does it provide society? It's a good question when FINTRAC makes you do a bunch of homework with the threshold reporting and reporting suspicious transactions and behaviours. We'll dive in for this.

Intelligence Flow and National Impact

When financial institutions file reports with FINTRAC, the intelligence doesn't just sit in a database—it flows directly to the agencies fighting financial crime on the ground.

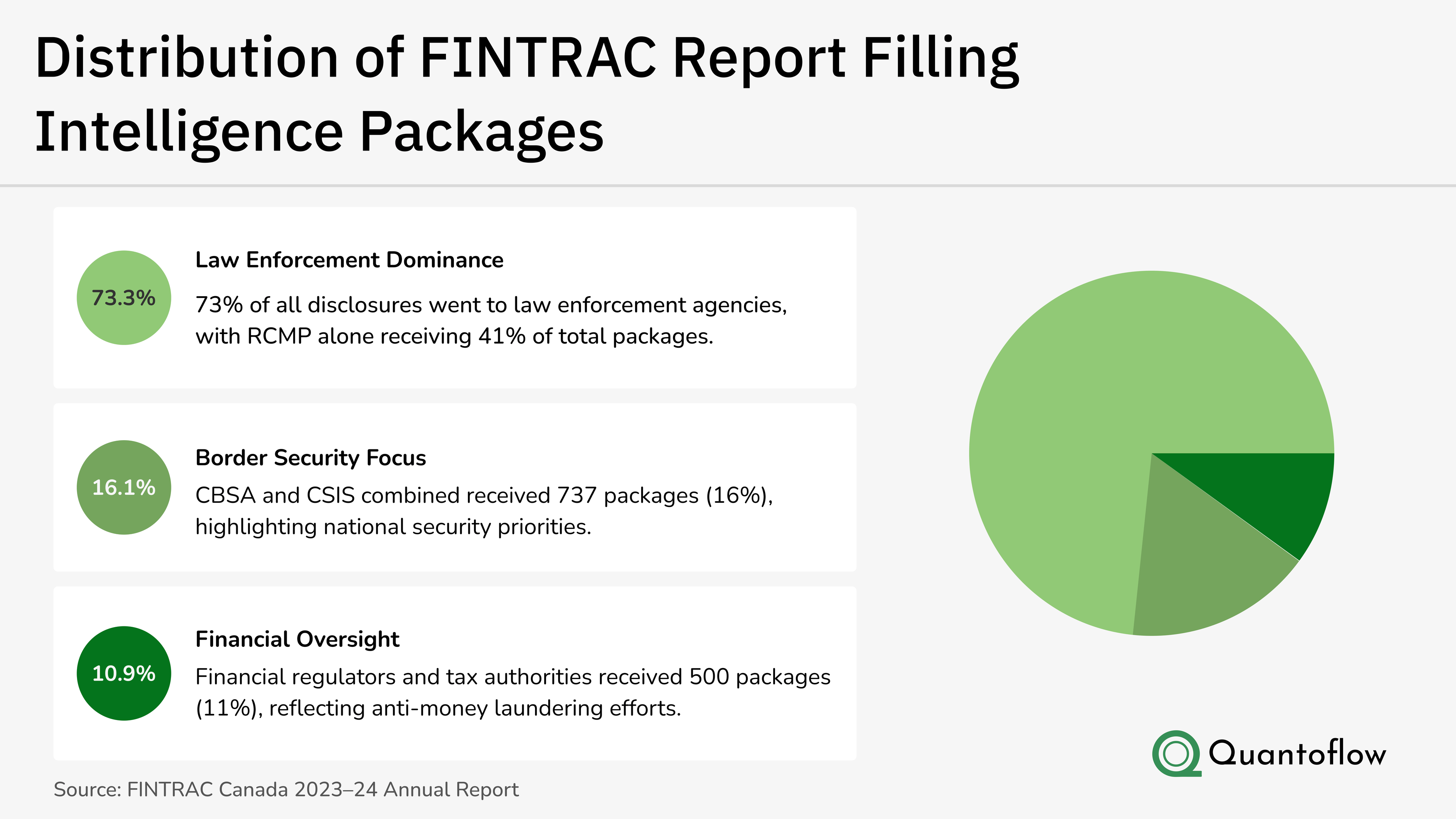

The numbers tell a clear story: 73% of all intelligence packages go to law enforcement, with the RCMP receiving the lion's share at 41%. This reflects FINTRAC's core mission of supporting criminal investigations into money laundering and terrorist financing.

Border security agencies (CBSA and CSIS) receive 16% of packages, underscoring the national security dimension of financial intelligence. Cross-border flows, sanctions evasion, and threat finance all trigger disclosures to these agencies.

Financial regulators and tax authorities account for 11%, demonstrating how FINTRAC intelligence supports not just criminal prosecution but also regulatory enforcement and tax compliance.

The takeaway for reporting entities: Your FINTRAC submissions have real-world impact. Every STR, LCTR, and EFT report you file could become a critical piece of evidence in a criminal investigation, national security operation, or regulatory enforcement action.

The Crucial Role of Financial Intelligence

FINTRAC's role extends far beyond just regulatory enforcement - it serves as a crucial intelligence hub for Canada's security apparatus. Recent data from FINTRAC's 2023-24 Annual Report reveals the strategic distribution of intelligence packages.

Law Enforcement

73.3% of intelligence disclosures are directed to law enforcement agencies, with the RCMP receiving 41% of all packages. This demonstrates FINTRAC's vital role in supporting criminal investigations.

Border Security

16.1% of packages went to CBSA and CSIS, highlighting FINTRAC's significant contribution to national security and border integrity.

Financial Oversight

10.9% of packages support financial regulators and tax authorities in their anti-money laundering efforts and compliance initiatives.

This distribution pattern underscores FINTRAC's crucial position as an intelligence nexus, effectively bridging the gap between financial institutions and law enforcement while supporting national security objectives.

Enforcement Patterns and Outcomes

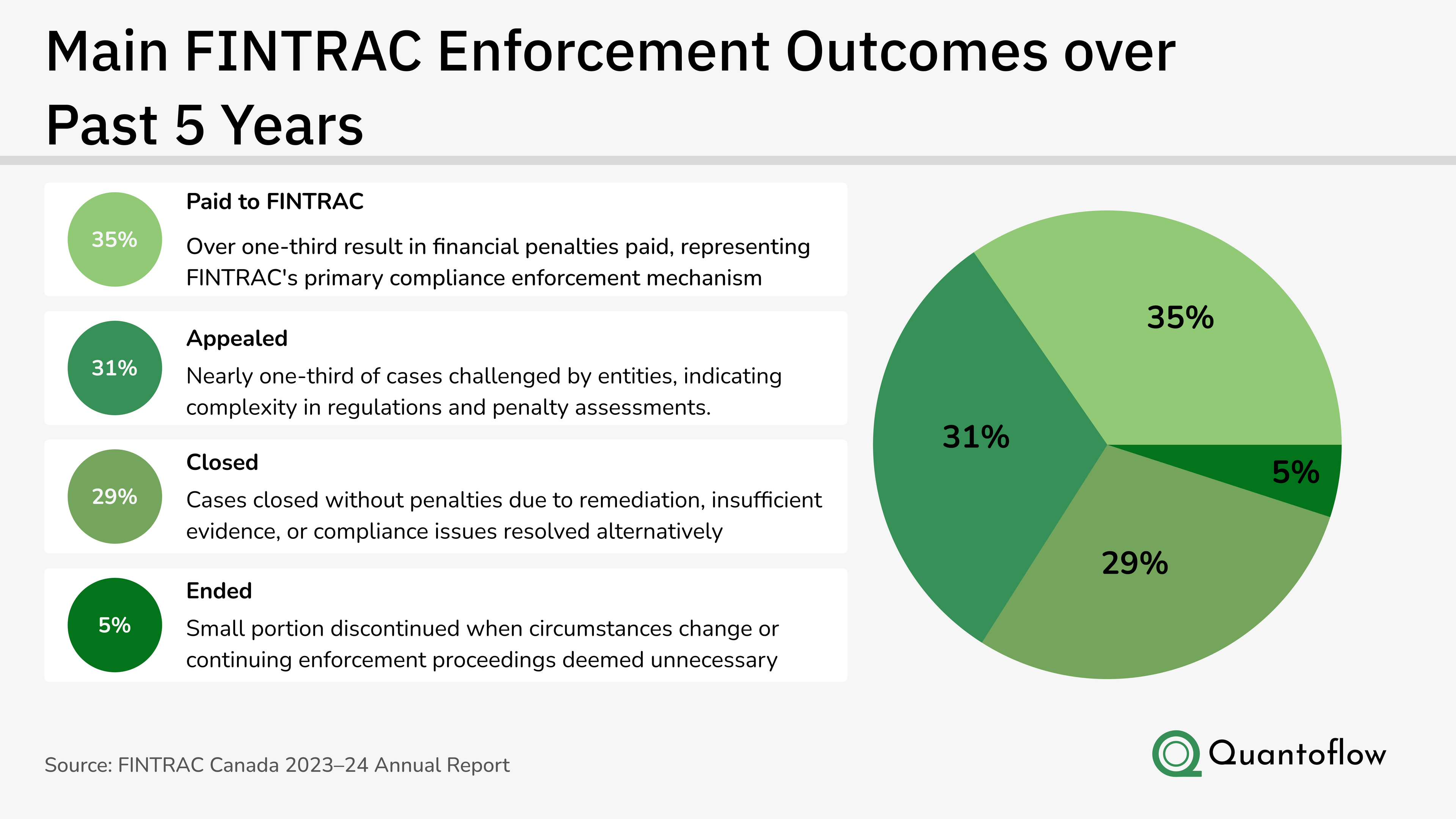

There are difference places where FINTRAC cases end up going. In the graph below shows a few outcomes that occur with companies that experience regulatory fines from FINTRAC for non-compliance.

Analysis of Enforcement Distribution

Key Statistics

- 35% result in monetary penalties

- 31% of cases are appealed

- 29% closed without penalties

- 5% enforcement proceedings discontinued

What This Means

The high appeal rate suggests either:

- Disagreement with penalty assessments

- Complexity in regulatory interpretations

- Need for better compliance documentation

- Importance of proper legal preparation

Organizations subject to FINTRAC oversight should be prepared not only for potential penalties but also for the possibility of extended proceedings through the appeals process. The substantial appeal rate highlights the importance of maintaining detailed compliance documentation and being prepared to defend practices and procedures if challenged.

Strategic Implications

Future of FINTRAC Compliance

Critical Focus Areas

Financial institutions operating in Canada should prioritize:

- Robust compliance programs

- Suspicious transaction reporting systems

- Documentation and record-keeping

- Staff training and awareness

Important Reminder

FINTRAC identifies suspicious transaction reporting as "critical to FINTRAC's ability to generate actionable financial intelligence". With proposed penalty increases and enhanced regulatory powers on the horizon, the cost of non-compliance is set to rise dramatically in the coming years.

The strategic distribution of intelligence packages demonstrates that compliance isn't just about avoiding penalties - it's about contributing to a broader national security and law enforcement ecosystem.

Citations

- FINTRAC 2023-2024 Annual Report https://fintrac-canafe.canada.ca/publications/ar/2024/ar2024-eng.pdf